Bitcoins - digital currency

Bitcoin is a peer-to-peer digital currency. Peer-to-peer (P2P) means that there is no central authority to issue new money or keep track of transactions. Instead, these tasks are managed collectively by the nodes of the network. Advantages:

- Bitcoins can be sent easily through the Internet, without having to trust middlemen.

- Transactions are designed to be computationally prohibitive to reverse.

- Be safe from instability caused by fractional reserve banking and central banks. The limited inflation of the Bitcoin system’s money supply is distributed evenly (by CPU power) throughout the network, not monopolized by banks.

Total size 5,811,700 BTC

or 4,585,431 USD

or 3,545,137 EUR

or 133,094,323 RUB

or 3,849 ounces of gold

Any value to this idea or will it never work?

P

At 20k I kept thinking "surely it can't be as easy as buying now and waiting for the halving for the next bull run like clockwork, or everyone would be buying now"

I'm tempted to think similarly about it going to 100k+ now and I have to remind myself that yes, it's actually that easy.

The four-year cycle theory seems like such a crude way to analyze the markets—yet it applies to BTC proxies as well as BTC itself.

Based on four-year cycles tied to the halvings, 2022 was a red-candle year (the bear market). But 2023–2025 were/are all expected to be green-candle years, and so far this is all playing out as expected. You didn't even have to time the bottom exactly; all you had to do was buy BTC and BTC proxies in the first week of 2023:

BTC has done a 4x since then.

MSTR has done a 9x.

COIN has done an 8x.

CLSK has done a 10x.

MARA has done a 6x.

RIOT has done a 2.9x.

HUT has done a 1.7x.

Those are all remarkable gains, and we're still ~6 weeks out from the halving. There are so many months to go in the current bull cycle.

Bob Loukas has posited that this could be a left-translated cycle, meaning that the peak might come earlier than it typically does. That might happen, or we might just see taller green candles in 2023 and 2024 than in 2025, or a double top of some kind. Regardless of when exactly the peak occurs, there should be plenty of opportunities to take massive profits later this year and in 2025.

This guy has been putting out a lot of interesting info. The ETFs were a big catalyst that pushed us before the halving so much which is unprecedented as far as I know.

https://youtu.be/jTn3YoX9zao?si=AWFGYG7R...

This new breakout here 70,600s is off an ascending triangle chart pattern. Real bullish stuff here

It's going to rip today, isn't it.

Yeah we rip. The moves off triangles are powerful

It took just 7 weeks for the iShares Bitcoin ETF to cross above $10 billion in assets, the fastest for an ETF EVER. The prior record was held by the first Gold ETF which took over 2 years to hit that mark after launching in Nov 2004.

https://twitter.com/charliebilello/statu...

ETH broke out first. It hit highs like two days ago. So it's a good leading indicator to watch for BTC.

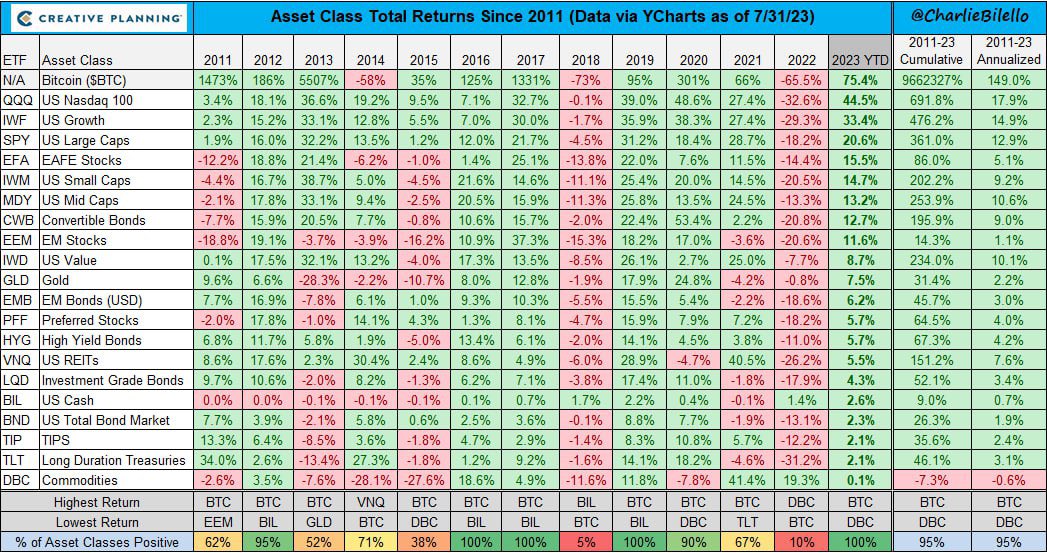

Bitcoin is the largest gaining asset class 3 out of every 4 years. So far the cycle has continued with the bull run starting earlier than normal.

One thing that was keeping the price down were the BTC dumps by Grayscale. Grayscale was selling off BTC because of the bankruptcies of Genesis and FTX. Both held shares at Grayscale.

Some people enjoy buying themselves fancy clothes. Others are fond of getting pampered at a spa. And others would love nothing more than to travel around the world and stay at nice hotels.

Myself, I love to check the price of BTC and see a 5-digit number starting with a 7. I guess I am a man of simple pleasures.

Mondays are the best!

Leading up to the ETF approval, what kind of predictions/estimates were being made for the quantity of bitcoin that ETF custodians would purchase? Has reality outpaced those predictions? Trying to understand how much (if any) the near/medium term outlook on bitcoin has changed since early Jan as a result of the ETFs.

MSTR almost own 1% of global supply

Yeah we rip. The moves off triangles are powerful

It took just 7 weeks for the iShares Bitcoin ETF to cross above $10 billion in assets, the fastest for an ETF EVER. The prior record was held by the first Gold ETF which took over 2 years to hit that mark after launching in Nov 2004.

https://twitter.com/charliebilello/statu...

ETH broke out first. It hit highs like two days ago. So it's a good leading indicator to watch for BTC.

This is the kind of shape based analysis I can wrap my head around.

Legacy Assets are Slowly Sinking when valuated in US Currency... actually, in ANY global currency.

The total supply of BTC is 19.65 million, so MSTR owns >1%.

21 million is the maximum supply that there will ever be, but this number won't be reached for some time. (The last BTC is scheduled to be mined in 2140.)

Moreover, estimates are that >6 million BTC have been irretrievably lost, which would reduce the total available supply to 13.65 million, bringing MSTR's share up to 1.5%!

thanks captain obvious...

We're all gonna get rugged

Some people enjoy buying themselves fancy clothes. Others are fond of getting pampered at a spa. And others would love nothing more than to travel around the world and stay at nice hotels.

Myself, I love to check the price of BTC and see a 5-digit number starting with a 7. I guess I am a man of simple pleasures.

same and 6 figures will be even more fun.

Legitimately think its because the price at 30K just got it too far out of most people's sphere of imagination. When it was $15,000 it's still sort of in "well thats a few month's salary for me". Now it's at "that's a year's salary for me, that's another thing those rich *******s get to do and normal people don't". Do they understand you can buy portions of a bitcoin, of course not. It's just that they see the price and assume they can't do it anymore, another missed opportunity.

Legitimately think its because the price at 30K just got it too far out of most people's sphere of imagination. When it was $15,000 it's still sort of in "well thats a few month's salary for me". Now it's at "that's a year's salary for me, that's another thing those rich *******s get to do and normal people don't". Do they understand you can buy portions of a bitcoin, of course not. It's just that they see the price and assume they can't do it anymore, another missed opportunity.

That's a great point. Many people don't realize that you can buy portions of bitcoin. It's part of the reason for this crazy MEME coin season. People can buy millions for very little.

I honestly don't think anybody is ready for the supply shock that is coming once the ETFs have gobbled up most of the available bitcoin. And this time it will be with the first-and-only truly scarce asset with a fixed supply that will never increase.

And nation states haven't even really started yet. Or billionaires. Or corporations. Or anything. Just phychos, Saylor, and Blackrock/Fidelity/et al so far.

99.999999% of the planet has no idea what this means. That leaves about 8,000 who do, which I think is fair, but probably still a little ambitious.

I just sold little last week (etf) .

But I put it in miners today (another drop of near 10% in a day, like 20-25% in a week and already pretty low ) ….

I just don’t understand why being so beat up while bitcoin ripping up …

Miners got to keep up with price at some point ….

.

The total supply of BTC is 19.65 million, so MSTR owns >1%.

21 million is the maximum supply that there will ever be, but this number won't be reached for some time. (The last BTC is scheduled to be mined in 2140.)

Moreover, estimates are that >6 million BTC have been irretrievably lost, which would reduce the total available supply to 13.65 million, bringing MSTR's share up to 1.5%!

How do we know the 6m are lost? Don't dormant wallets from years ago come back all the time?

Seems like a really hard thing to estimate

I honestly don't think anybody is ready for the supply shock that is coming once the ETFs have gobbled up most of the available bitcoin. And this time it will be with the first-and-only truly scarce asset with a fixed supply that will never increase.

And nation states haven't even really started yet. Or billionaires. Or corporations. Or anything. Just phychos, Saylor, and Blackrock/Fidelity/et al so far.

99.999999% of the planet has no idea what this means. That leaves about 8,000 who do, which I

and to add to that supply created gets cut in half approximately once every 4 years.