Mission to Retirement and Fun Spreadsheets

I like to think of retirement as not getting to a point where you just laze around and do nothing, but a point in life you reach where the interest on your money (not including the principle) reaches and slightly exceeds your expenses. Like many of you, I want my money to grow like bacteria. Growing wealth is really a race against inflation and to some degree everyone else.

I think that this forum has the type of people that are interested in spreadsheets. I've decided to share the spreadsheets I use for financial planning that have been evolving over time to be more efficient. Hopefully someone else might find this useful or might even have stuff to share themselves.

Firstly, wealth is calculated by compounding profit which is income - expenses. So those are the 3 main things to focus on in my spreadsheets (income, expenses, profit).

I have 3 sheets that I use for budget planning:

1. Estimate

2. Actual

3. Cashflow

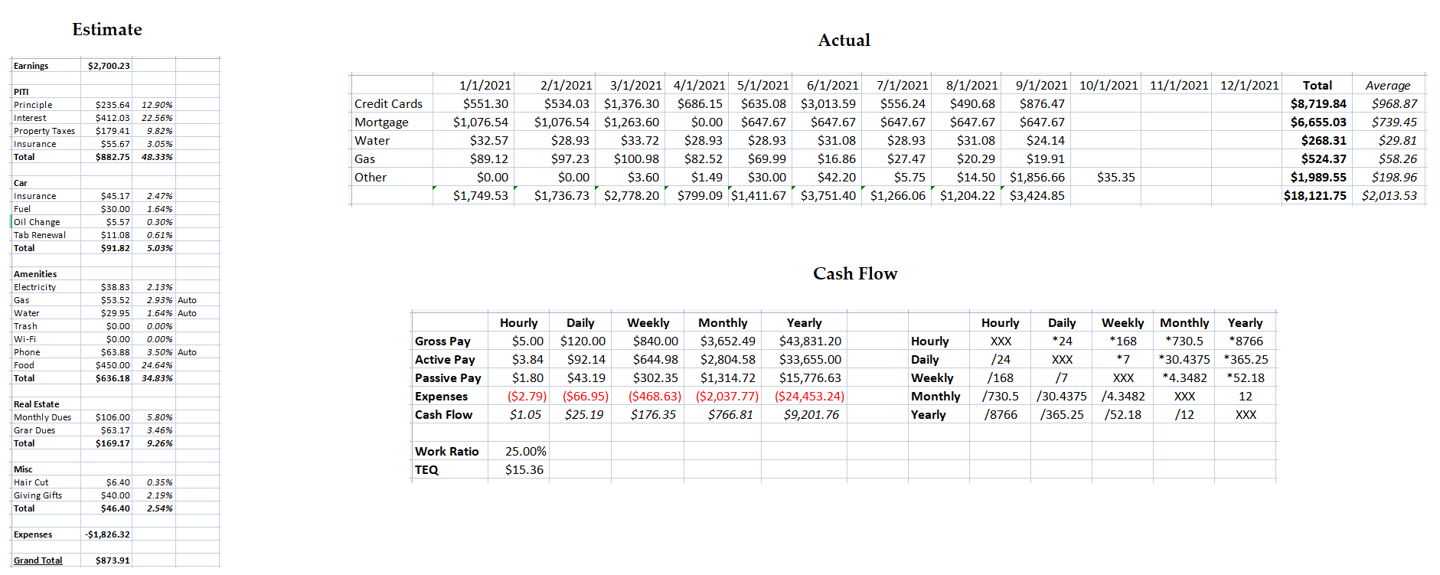

The Estimate sheet (see picture) shows where my money is mostly going and adjustments I can make to optimize my spending. The estimate sheet is calculated as a monthly expense. Periodic expenses are averaged out to the month. For example I pay $271.02 in car insurance twice a year, so I divide that number by 6 to get $45.17.

From looking at the budget sheet, I can notice that when I pick up overtime at my work my Grand Total goes significantly higher. If I double my Earnings at the top, my Grand Total goes to $3,574.14 rather than $873.91 which is 4 times as much. Another thing to notice is my Real Estate liscense is 9.26% of my expenses. I'll have to make a decision on whether to keep that or just call it quits by October 31st. I may also upgrade my haircut and give nicer gifts on birthdays and Christmas since that only amounts to 2.54% of my expenses.

The Actual sheet (see picture) is more important since it shows what I am truly spending per month. I only have 4 categories for this, because having the same items from the estimate sheet would be too time consuming to update. My average spending so far is $2,013.53 per month so I am a bit over my estimate by about 10%. My estimate sheet doesn't really account for big purchase items such as the rider mower I bought back in June.

The Cash Flow sheet (see picture) shows Gross Pay which is earnings before taxes. Active Pay which is net pay (earnings after taxes). Passive Pay which is a fictiticious number that is based on my networth in stocks, retirement, and crypto currency multiplied by .07. Basically a guess about how much I'm making while doing nothing. I haven't updated this number in awhile, but is more of a ballpark number and shouldn't be focused on too deeply. Expenses will eventually be derived from the total on on the Actual sheet, but for now I use the average and multiply by 12. Cash Flow is Active Pay minus Expenses.

On the right side of the Cash Flow sheet is a conversion chart. For my Active pay I take the average amount I make in a week, $644.98, and use that number to fill out for monthly, yearly, hourly, and daily using the conversion chart. So for a year there are 52.18 weeks in a year. $644.98 * 52.18 = $33,655.06. Looks like my sheet is off by 6 cents, but that isn't a big deal. Something to note, the hourly pay is based on 24 hours in a day and not how many hours I'm actually working. That number is TEQ which will come later.

The Work Ratio number shows 25%. I alternate between 36 hour and 48 hour shifts every week which averages to 42. There are 168 hours in a week. 42/168 = 25%. If I drove far to work I would consider that to be included in the Work Ratio, because that is time being taken out of my day. Jobs that are closer or remote jobs are valued higher over jobs that have driving distance. Finally comes TEQ (Time Efficiency Quotiant) for how much money your hours of work are worth after taxes. This is the true hourly that matters. That number comes to $15.36. This number can be compared to other jobs that are further away that may pay a bit more, but you're not sure if it is worth it. Another use case for this, is to figure out if something can be done by you or hiring someone else to do it. For example, if I have a project that takes 2 hours to do, but I can hire someone else to do it for $25, I should pay someone else to do it, because (15.36 * 2) > 25. On the contrary, if it costs $50 I should take care of it myself.

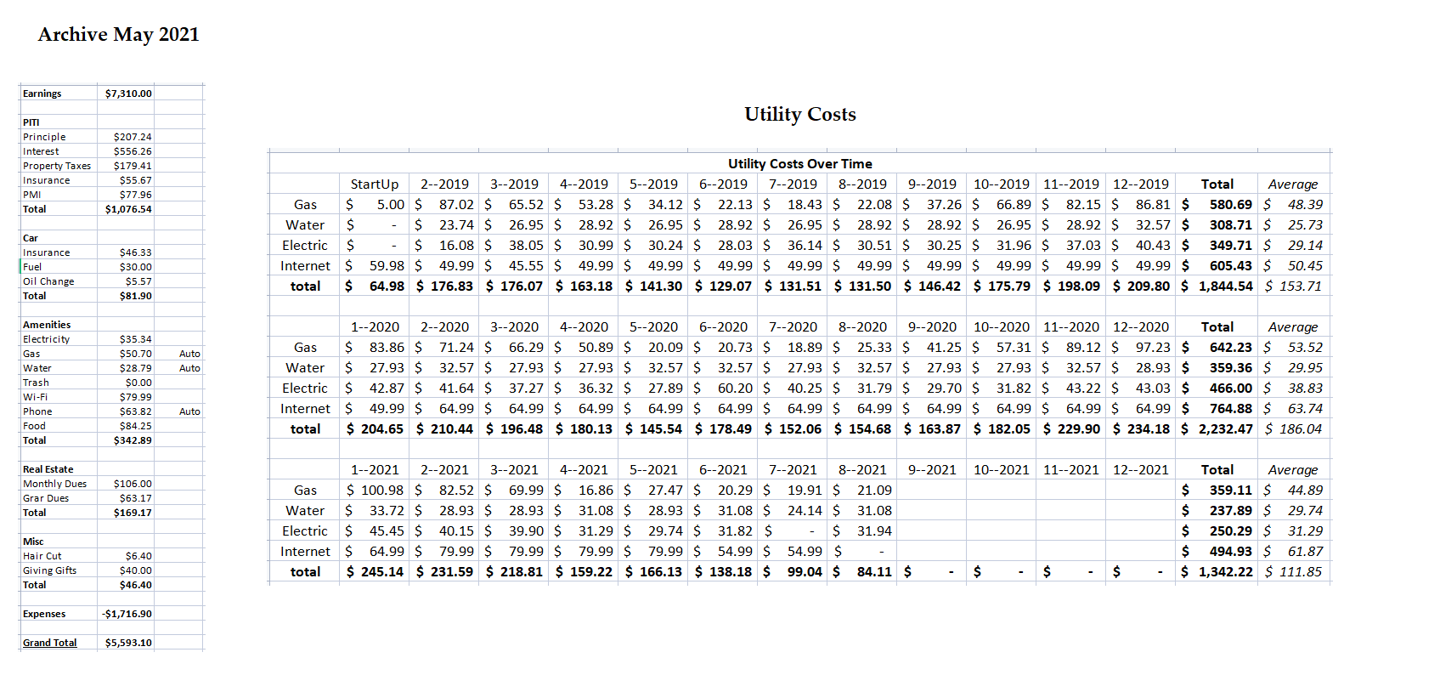

Keeping archived Estimate sheets of the past as well as Utility Costs can help see how inflation is affecting you over time (see picture). The Actual Sheet can also be looked at. This probably is less important, but I'm weird and find it fun to keep track of.

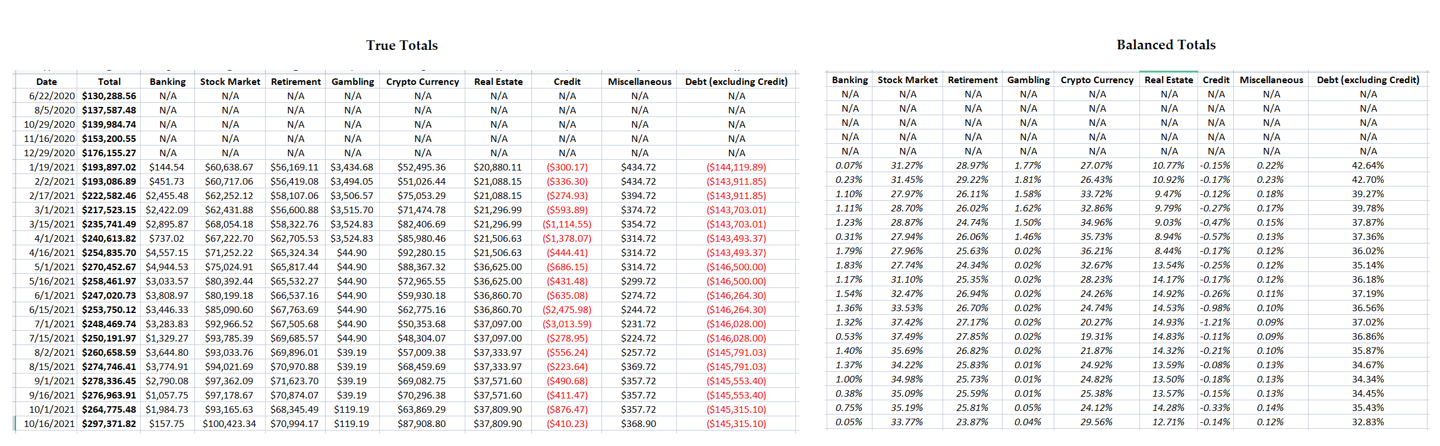

Knowing the distribution of where your money lies is also important (see picture). You can also use it for other metrics. For example, I used Stocks, Retirement, and Crypto Currency to determine Passive Pay on the Cash Flow sheet. I can also eliminate crypto currency from the sheet and see where I'd be standing if Bitcoin and crypto currency went to $0 due to a black swan. If one group starts to become too big I can readjust to balance things out in order to avoid possible bad future outcomes beyond my control.

These numbers can also tell a story. On May I can see the jump in real estate which was the month where I refinanced my house. (For real estate, I don't regularly update the equity based on the market, because it is a bit of work and also it is not as liquid so I decide to keep it for the most part at a consistent price to give a conservative estimate). On the right hand side there is a column called Debt (excluding Credit) which is calculated by Debt/(Networth + Debt). This may seem weird at first that I didn't do Debt/Networth, but the full value of my house should be included in the networth equation since it is collateral. If I was to sell my house today all the debt would be wiped out and the Real Estate is what would be leftover which is why I don't subtract the debt from the networth when calculating the total. Debt (excluding Credit) is one of my favorite metrics to look at. I have moved my money off of Gambling in April since it has historically been a lower performer for me.

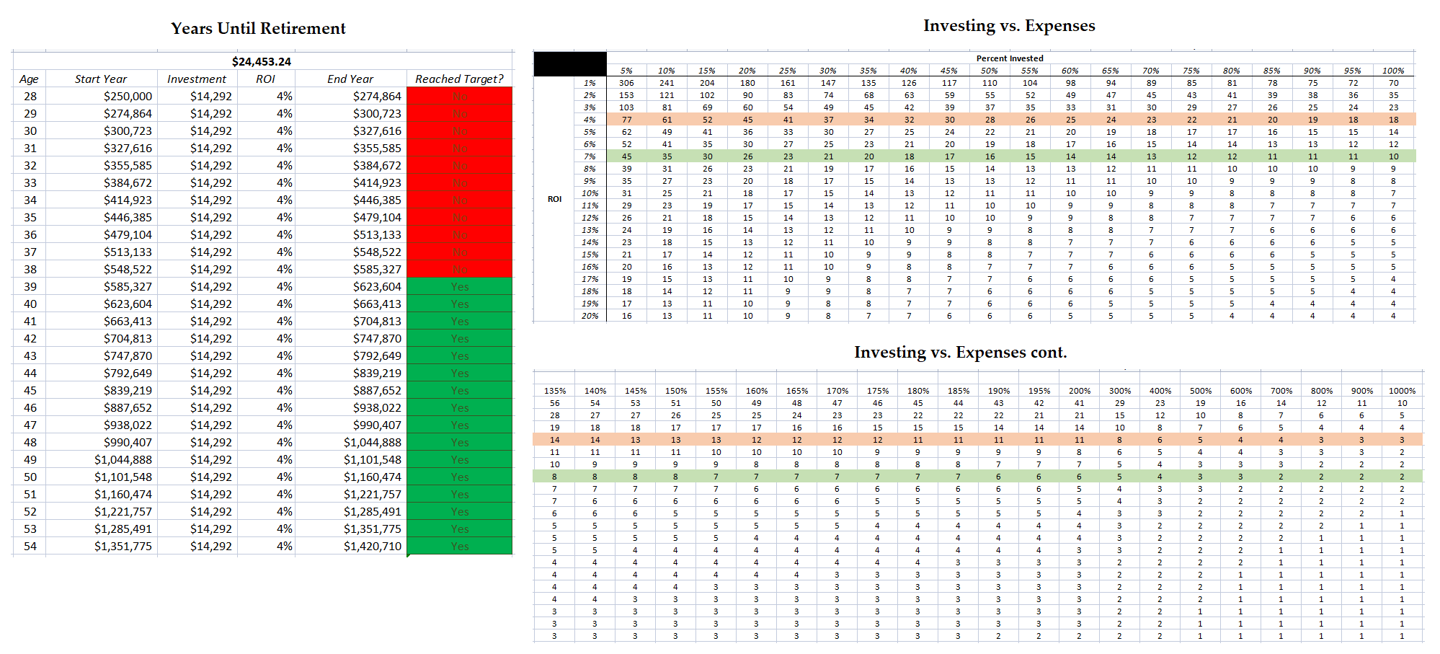

Retirement can be calculated by annual expenses divided by ROI. I believe the best way to think of ROI is after you subtract inflation. So if I get 7% return on average in the future with 3% inflation average every year I make the ROI 4%. The 4% rule for retirement is essentially taking the interest from your investments and spending that, but keeping the principle so that it doesn't run out. I used to mistakenly use 7%, but inflation is a pretty big deal. In the picture, there is a column that says "Reached Target?". It takes expenses, which is in the top in bold, $24,453.24 divided by 4% ROI and if that number is less than the number in the end year column then the box turns green with "yes" written in the box. Otherwise it is red and says "no".

In the Invested vs. Expenses, it lists the number of years it would take to retire given a certain percent invested in proportion to expenses you have, and an expected ROI. I highlighted red boxes for 4% and green boxes for 7%. A lot of financial advice that I've heard/read is about investing a percentage of your income into retirement, but the better metric is expenses because the more expenses you have the longer it will take to retire. Essentially they are kind of the same thing, but the latter metric makes you think in preportion to your spending which makes a lot more sense to me. If you have a 4% ROI it will take 18 years for you to get to a point where you can generate the same amount of money you put in that can safely be taken out. For 7% it is 10 years. If you can invest double your expenses at 4% it takes 11 years. With 7% it is 6 years. If you take the advice of putting 10% of your income into investments, which is most likely 11% of your expenses, it will take about 61 years to retire at 4% which kind of sucks.

One thing this table doesn't take into acount is social security, rising expenses over time, paying off your mortgage, and other things. I guess there is the strategy of having a nestegg last until you die, but I find that outlook super depressing and it is a lose-lose situation, because either you die which sucks or you live unexpectedly for a long time and have no money. That leads me to the next chart.

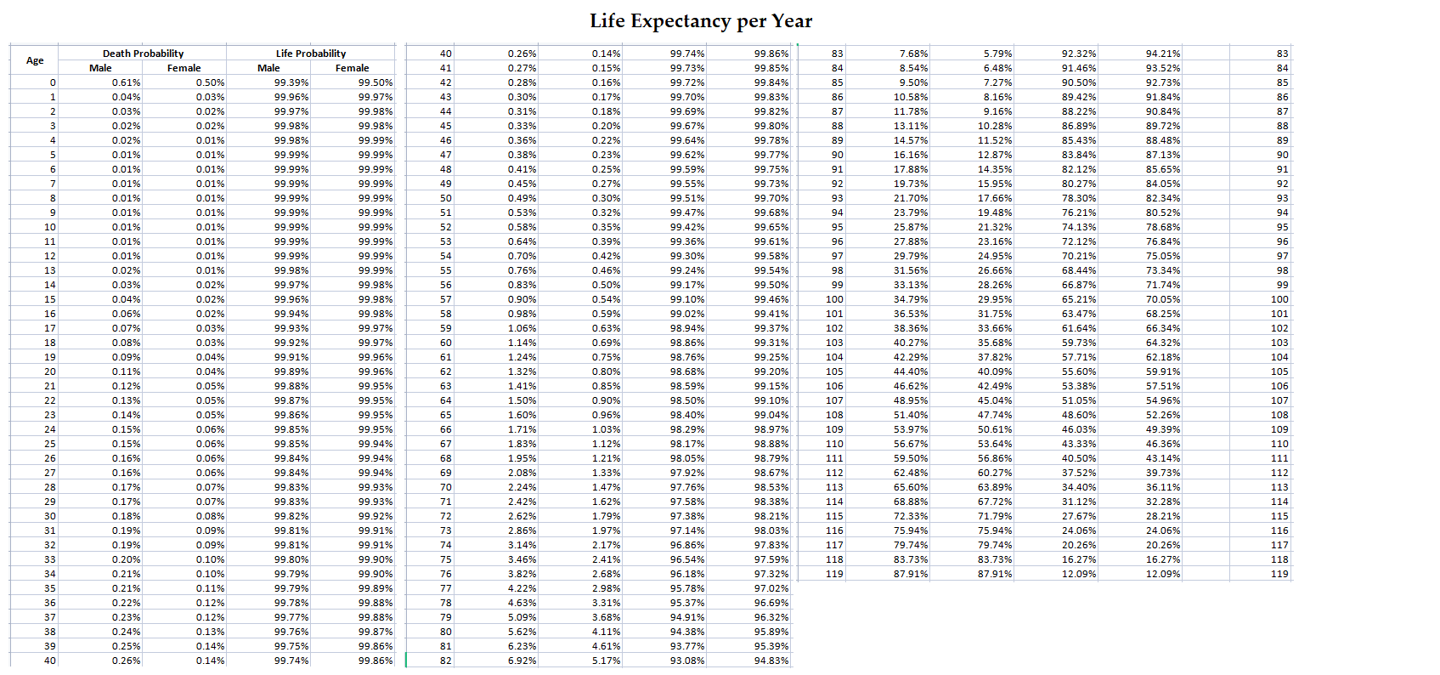

These next two charts have death probabilities. I covered them in spoil tags because some may find it depressing.

Spoiler

This data is derived from the social security website: https://www.ssa.gov/oact/STATS/table4c6....

This data was collected in the US. It gives an aproximation of your chances of death in that year given your age. As you can see, it is pretty hard to live past 119 given current conditions. I would imagine the number to be lower for most considering people with a terminal illness would shift the average.

This gives the odds that you'll make it to each decade given that you're male. As you can see making it to 30 and 40 is fairly likely. Dying before 50 is a 1 in 20 shot. 60 is 1 in 8. 70 is 1 in 4. 80 is a coin toss. Making it to 90 is unlikely. The odds are no longer in your favor with 1 in 5 that you live. Making it to 100 is about a 1%, but still can happen. I guess the biggest take away from this is to not be too much of a scrooge, because then you might die before you get to experience some of the great luxuries.

I've actually toyed with the idea of having ROI be 2.5%, but that may be too conservative. Perhaps I should just stick with 4% and if the market starts tanking to just tighten up or maybe pick up some extra work. Cheers.

2 Replies

I didn't used too, but I now have money in a money market account at close to 5% ROI per year.

Why don't you just stick it all in the SP 500 and make 10% a year without even thinking? I think that's the clear way to go - for most though they find this boring and like to play around but that costs you money in the long run.

I got rid of all my individual stocks and am in 100% VOO.

I still own some Bitcoin, but I've been reducing my position in it over time.

I now play poker full time which is quite amazing to have so much freedom to do this. I kind of feel like I'm retired a bit even though I'm not. I usually keep about $4k on the poker site I play on, but I move my bankroll over to a money market account so that it earns interest while I'm not playing. I've got my poker bankroll to about $20k which is very nice. I've been playing a mix of 200NL, 100NL, and 50NL.

My networth has now reached past the $500k mark, so I'm half way to being a millionaire which makes me very happy. Becoming a millionaire is something I've wanted and I feel strongly that I will likely reach that in this decade. I know inflation is making it less exclusive, but at the same time I feel it is a lot of money and I'm in a spot where I really want to be.

I was in a relationship for awhile last year, but it didn't end up turning out too well. As of now, I plan on being single. I used to feel like I was always missing out with all these other people I know in relationships, but I think I enjoy being single a lot more. The only downside is that I won't have sex and no children, but I think the cons outweigh the pros. For the most part, I already have what I need.

I didn't used too, but I now have money in a money market account at close to 5% ROI per year.

I got rid of all my individual stocks and am in 100% VOO.

I still own some Bitcoin, but I've been reducing my position in it over time.

I now play poker full time which is quite amazing to have so much freedom to do this. I kind of feel like I'm retired a bit even though I'm not. I usually keep about $4k on the poker site I play on, but I move my bankroll over to a money market account so that it earns in

I mean if you're single with no kids becoming a millionaire isn't much of an accomplishment. Can probably make 100k a year with such low living expenses and get there in like 7-8 years investing.