TSLA showing cracks?

With TSLA going in the past few days from 130 to 110 and now back up to 120, it seems the market is a bit on edge about this stock. They report earnings on the 23rd, and with the incredible run up it's had in the past 3 months (40-->120) I get the feeling that if they don't blow people away this stock has the potential to crack pretty violently.

With articles coming every day for and against TSLA, I generally believe it to be vastly overblown stock. They are never going to be able to sell enough cars at $80k to be extremely profitable, and 5 years is a long time to wait with no profits for the time they supposedly have a $40k model that will ready for mainstream.

Thoughts?

Some prognosticating for potential future cracks: Obviously the biggest risks are that they don't win the autonomous-driving race (which I highly doubt they will, and which I don't think they even have a lead in, despite bulls' insistence), and that demand fizzles out (largely due to the fact that, finally, there are plenty of other comparable EV options from major automakers). I don't know how much Elon's political takes have alienated his core userbase, but it seems like it's at least a concern, further eroding demand.

But the reason I'm posting is that I think there's a good chance the overproduction of cars in China ends up deeply hurting damn near every automaker, but especially Tesla. I think Tesla's sales in China are going to decline in the face of all the EV automakers that have been subsidized by the Chinese government and that have overproduced units, so TSLA's growth case in China goes into the trash. There's also a good chance that these Chinese EVs—and Chinese ICE vehicles, of which there are actually many more units than EVs—find their way to other countries and undercut Tesla. I'm mainly speaking of Europe, as some countries are going to be less strict on their protections against Chinese-made products. If you live in a country where right across the border you can get a car just as good as what's available in your home country, but for 60% of the cost, you're going to try to find a way around your country's trade barriers. The US has doubled down on its trade war with China, with Biden recently announcing 100% tariffs on some Chinese goods, and Trump surely isn't going to seek a free-trade policy with China if he's elected. So Tesla looks to be fairly well protected from the Chinese leviathan here in the US, but I wonder if even that fades away in the longer term. You can imagine China relocating some of its capacity, or even rebranded finished cars, to Korea or Vietnam, with whom there are much lighter trade restrictions, and these cheap cars eventually find their way to the US. Whatever happens, having this much extra supply in the world—both EVs and ICE—is a big negative pressure for automakers. I'm not sure how strongly the effects will propagate through global markets, and how well the most important markets of the US and Europe can shield themselves from those pricing effects, but I'd be very worried holding automaker stocks here, especially TSLA.

As for why now, since I could have said essentially the same thing a couple years ago, China is now pretty saturated with cars, sales are stagnant, yet production capacity has grown. China's capacity for ICE + EVs is probably a bit north of 40m units a year, and domestic demand is maybe half that going forward. That's a lot of spare capacity for a country that is now in something of an economic downturn, with a centrally planned economy that's looking to keep people employed and producing stuff. I could imagine this capacity finds its way to merge with the flailing VinFast (Vietnam) and "launder" the cars to consumers in China-hostile countries.

if i were a tesla shareholder this would probably be the point at which i would sue the ceo of the company:

Elon Musk ordered Nvidia to ship thousands of AI chips reserved for Tesla to X and xAI

Emails circulated inside Nvidia and obtained by CNBC show that Elon Musk told the chipmaker to prioritize shipments of processors to X and xAI ahead of Tesla.

Musk has said he can grow Tesla into a major player in artificial intelligence and that the company is spending heavily on Nvidia’s AI processors.

By ordering Nvidia to let X jump the line ahead of Tesla, Musk delayed the automaker’s receipt of over $500 million in processors by months.

if i were a tesla shareholder this would probably be the point at which i would sue the ceo of the company:

I guess FSD is less of a priority than Grok and whatever shady **** they are doing at xai

Just chopping his publicly traded company off at its knees to feed his personal projects

Elon thinks he's Grok King; he's got it all figured out. I mean, he said it himself, he knows more about manufacturing than anybody else.

But soon, the majority of shareholders will have grokked that he's, for certain, an individual who lacks empathy, leaving the many retirees' hedge fund gains inTSLA Fokked.

Gonna be worse than Enron.

Now that these chips are being redirected, RoboTaxi unveil on 8/8 going to be the flop of all flops.

I also see SpaceX losing launch clearance from the FAA soon. The fireball that happened recently in a suburb of Dallas pissed off the wrong socio-economic group of Texans.

Surprised there is nothing here on Elon's Pay Package vote.

There isn't a whole lot to say as it was always going to pass. Do you believe Elon is more or less than 10% of Tesla's value? I think hes nearly a liability at this point but I don't own the stock so what I think doesn't matter. Shareholders still see him as driving a massive portion of Tesla's value. Stock should rally now that the uncertainty is out of the way even if its at the dilution of the shareholders

Eh, if TSLA shareholders are so eager to get massively diluted who are we to complain? Of course the court may still have something to say about it but it would be tough to argue that the shareholders aren't adequately informed this time around. If they aren't they have no one to blame but themselves.

I would guess most people here own the stock, because if you own an index fund and you don't have a separate short position, you own the stock. I haven't really been following the issue since I can do nothing about it and I don't want to bother hedging my ownership with a short, but it is a transfer of wealth from basically every investor and retiree to Elon. TSLA is just over 1% of the SPX.

smart move to hold shareholders hostage. they had no choice because if he leaves the stock can no longer enjoy its delusion premium and will fall to double digits. just brilliant that it got passed after the story broke that he's ****ing over the company to benefit his private ventures. now the stock faces another headwind in the form of elon dumping $50B in shares on the market to reduce his exposure to a sinking ship. i expect him to soon come up with an excuse why he has no choice but to step down so he can save face and pretend the company's failures were due to his departure rather than, say, him being a con man.

It's kind of a no-win situation, isn't it? Tesla's stock price is largely attributable to hype. Musk leaves and the hype dies. So they have to keep him at all costs.

Yeah pretty much. Without Musk I think the perception is they turn into "just" a car company. I wouldn't be surprised if a poll showed that shareholders believe that without Musk Tesla never achieves FSD.

I like these guys:

The problem with EVs is it's too awkward if you want to take a trip with your family, or you work as a delivery driver or a taxi driver and then you have to find a charging point, which when you arrive might already be occupied.

Plug in Hybrids are the future.

Tesla is likely going bankrupt.

Long Toyota, Ford and GM short Tesla.

I agree that its a ****ing pain in the ass at times but it seems teslas response to you are a) we will continue to improve our battery and length and 2) we have been opening up more and more charging stations that are cost efficient and time efficient with speed

will never know about the former but the latter is true in my area and other areas as well as you can charge any NON tesla ev at their stations as well at the newer ones

Tesla Energy is the real key to everything here. It solves a lot of problems for the company. Governments are going to be an enormous source of demand for these megapacks. Energy security is a primary concern for many organizations and businesses. If the power goes out having a backup is very valuable.

This is where the sales process by Tesla allows it capture essentially the whole market. The reason being that their speed of installation is probably faster and their technology is probably superior, especially from a software standpoint.

In just one quarter Tesla Energy went from 4 to 9.4 gwhs installed. A 133 percent quarter over quarter increase. Plus they get service revenue from each megapack installed for the life of the pack to handle maintenance.

They are a one-stop-shop for utilities and governments that is able to offer a turnkey energy storage solution at a price lower than probably anyone else.

So because Tesla is so focused on operational efficiency they have made what was viewed as a boring business ,a high margin business with no resentment from their customers.

Even with a gigantic capacity factory in California they cant build enough of these 1.3 Million dollar each megapacks to meet the demand. Thats what Warren Buffet would call a ‘high quality problem’.

The consensus EPS estimate on Tesla for this quarter is .60 per share. They are going to crush that number its just a question of by how much.

P/E of 63, so exponential sales are priced in but indications are they're flattening as china, big auto, and rivian eats market share. EV market isn't growing as much as people expected. also they're having to cut prices to maintain their sales numbers and profit margins have been in decline last two years. these are some bear cases / devils advocates takes, anyway. good luck if you decide to ape.

Tesla still trading in its descending channel. Latest pamp is because growth decay isn't as bad as original predicted.

i thought we all agreed that the car manufacturing business is whatever, and that tesla's value (or lack of, depending on your point of view) is all about fsd, battery technology, teslabot, AI etc

so, how come selling 15% more cars this quarter rather than the 11% expected added a Toyota Corporation to the shares

i thought we all agreed that the car manufacturing business is whatever, and that tesla's value (or lack of, depending on your point of view) is all about fsd, battery technology, teslabot, AI etc

so, how come selling 15% more cars this quarter rather than the 11% expected added a Toyota Corporation to the shares

It has to do with risk of ruin. The car business is capital intensive. It needs its factories to operate within some predictable range of utilization so that it can manage input and labor costs.

The first quarter proved that even with weaker demand that they are able to manage their cost structure and still show a healthy profit.

The reason the Tesla Energy growth rate is so valuable to the company is because the energy storage business is more profitable than the car business and with these types of growth rates in a completely unrelated business that is much more recession proof, their risk of ruin is rapidly approaching 0.

Its a balancing act between trying to achieve the fastest growth possible and being careful not to become overextended.

As a value investor Tesla Energy gives me confidence that even if the electric car market gets tougher the company is at worst probably going to break even.

True FSD is going to change the world and disrupt a lot of businesses. It might be the most valuable invention in human history.

People giving Elon a hard time dont give him enough credit for how good it already has become. There are people right now that are driving 50-100 miles without having to touch the steering wheel. Thats ****ing amazing to me.

Im still waiting for a true AI self driving car in all situation shrug

Broken YouTube LinkUntil then …

4m30 sec mark .

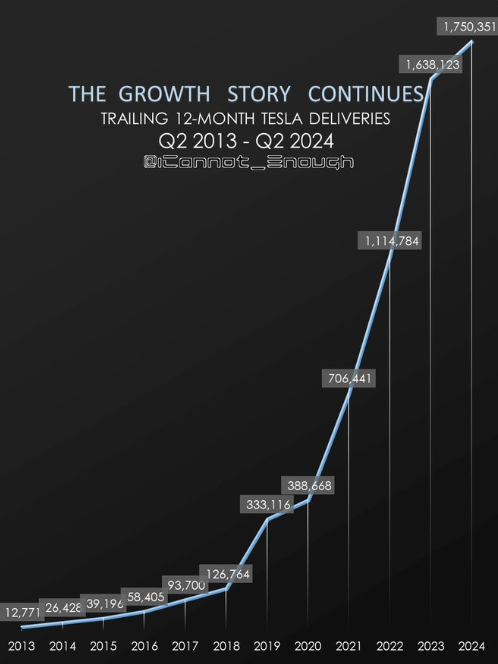

That chart is awful, revenue is now falling as of the most recent quarter.

Q1 2023 - $23.3B

Q1 2024 - $21.3B

Kinda weird to fomo into a company thats at 80-90x ntm earnings with no growth

The only reason to buy the stonk is if you believe the FSD debut will be a blowout, which imo is sort of already priced in even with the delay.

Only 3% decline for 45% drop in earnings ?

I’m not a stock expert but seems the force (cult) is strong in that one .

At least Musk secured his bag before the growth narrative could completely flip on its head.

lol

It was actually crushing the F-150 and looking impressive then the frame snaps in half at 6 minutes trying to tow an F-150

Where tf is Robotaxi 8/8 unveil?