The "LOLCANADA" thread...again

So what's new?

I've noticed the Liberals are now ahead in all major polls and Trudeau hasn't even started to campaign yet...i'd be shocked if they lost the election now.

Just shows just how incompetent Conservatives are.

lmao the globe and mail article putting the lie to this statement even includes a big disclaimer to people like lozen lolol

Warning: The following column is for mature audiences only. It contains many offensive words and phrases.

Such as: “You know, Canada’s fiscal position is actually pretty good.” And: “Compared to the rest of the G7, we’re in solid fiscal shape.” Or how about: “Data don’t lie; Canadian governments have low debt service costs.” And even: “A lot of things in Canada are broken, but the budget isn’t one of them.”

I recognize this is strong language for a family newspaper.

having less debt does not mean we have a good future economy. we still have debt and 70% of investment capital is put into buying homes. Debt actually barely matters in economics we have debt but we own others debts its w/e its a low educated thing to cry about. what actually stinks is whats under the hood like the massive brain drain and housing bubble. When you have 70% of all free capital going into buying housings that means no money is going towards improving production efficiency. for example america puts like 70% of excess capital into improving businesses and production and we put like 20% because it all goes into purchasing homes or into foreign countrys

Would you mind linking a reference for the precise stat you are talking about?

having less debt does not mean we have a good future economy. we still have debt and 70% of investment capital is put into buying homes. Debt actually barely matters in economics we have debt but we own others debts its w/e its a low educated thing to cry about. what actually stinks is whats under the hood like the massive brain drain and housing bubble. When you have 70% of all free capital going into buying housings that means no money is going towards improving production efficiency. for exam

The thing about the housing crisis make ms me chuckle a little because it was something long in the making and been exacerbated by the people themselves .

First off , when was the last correction in housing in Canada ?

Yeah go much further then the early 2000s.

We escape that earthquake in 2008.

When no correction occur for a very long time , people becomes complacent and think prices always go up and ends up buying at stupid price

« House prices never go down ».

Many uninformed buyers bought an over expensive house with a variable rates at 2% instead of locking that **** up at like 3% for 7-10 years …

Ah yes house prices never go down and Interest rates always go down ? shrug

My main hate about all this is when I see right wingers come here and blame everything except the consumer itself with big investments mistakes and yet praise policies where the consumers should be all responsible for their mistakes but when it happens , they revert back to be leftish and ask the government to bail them out or help them ….

Government has some responsibilities but to put it all on them like Trudeau is hilarious .

Ps: not necessarily aiming at you btw .

while government debt is mostly meaningless peoples debt is not because if your paying all your money in interest to banks that are often non Canadian owned that money leaves the country instead of going into local capital investment

I think it just a given at this point quality of life will go down from one government to the next...it has been a cycle for a bit in Canada really the only time it was broken was for Chretien.

Funny enough Trudeau Jr's first term was fairly good economic wise coming out of the mini recession that Harper finished with but the pandemic really screwed things up.

we lead the western world in lack of investments per employee which means we do not invest are money and we are falling being economically its very grim. The main reason is of course we are spending all our money on mortgages and even are rich are investing heavily in housing since the government would never let it crash this is the true problem of the housing bubble

we lead the western world in lack of investments per employee which means we do not invest are money and we are falling being economically its very grim. The main reason is of course we are spending all our money on mortgages and even are rich are investing heavily in housing since the government would never let it crash this is the true problem of the housing bubble

FWIW in not sure there is much corrolation about mortgages and investing by Canadians .

https://www150.statcan.gc.ca/n1/pub/11f0...

Investment in fixed capital has been weak in Canada since the mid-2000s. The ratio of investment to net capital stock and investment per worker declined after 2006, especially after 2014. As a result of this investment slowdown, the growth in labour productivity declined after 2006. This paper examines the sources of this weakness in capital investment in Canada using firm-level data. It finds that investment per worker declined by 20% from 2006 to 2021, and the decline in investment per worker was more significant in large and medium-sized firms, as well as in foreign-controlled firms, compared with that in small firms and in domestic-controlled firms. The weakness in capital investment after 2006 coincided with a change in the mix of investment toward intangible investment, and this shift toward intangibles was more pronounced among large and foreign-controlled firms. The paper finds that an increase in industry concentration and a decline in firm entry rates have a negative effect on firm investment, and the effect is larger among small firms. These findings are interpreted as evidence that a decline in competition leads to a decline in investment or competition promotes investment among firms, especially among small firms. After 2006, industry concentration changed little, while firm entry rates declined sharply. These decreasing entry rates accounted for 30% of the decline in investment per worker after 2006.

It was not exact data. i remember seeing can does close to a 70/30 split housing/investment capital where the states has a 30/70 split or something like. If you want the exact numbers look yourself I dont work for you that graph clearly shows a huge difference its the same thing just not broken down in %.

To get a sense of the proportions involved, investment in residential housing was 22.4 per cent of total investment in 2000 but rose to 41.3 per cent in 2021. Over the same period, investment in two asset categories critical to improving productivity — intellectual property products, including computer software, and information and communications equipment — fell from 30.3 per cent of total domestic investment to 22.7 per cent. In sum, in 2000 housing investment was only about two-thirds of what we might call “productivity investment” but by 2021 it was almost twice as great.

Obviously if the amount of canadas total gdp put into housing investments goes form 20-40% then the amount going into other things decreases this is coming out of things like research and development making are average worker less effective. I believe the average Canadian worker is about 35% less effective then an american worker because of this. We were pretty close to them 20 years ago

It was not exact data. i remember seeing can does close to a 70/30 split housing/investment capital where the states has a 30/70 split or something like. If you want the exact numbers look yourself I dont work for you that graph clearly shows a huge difference its the same thing just not broken down in %.

To get a sense of the proportions involved, investment in residential housing was 22.4 per cent of total investment in 2000 but rose to 41.3 per cent in 2021. Over the same period, investment in

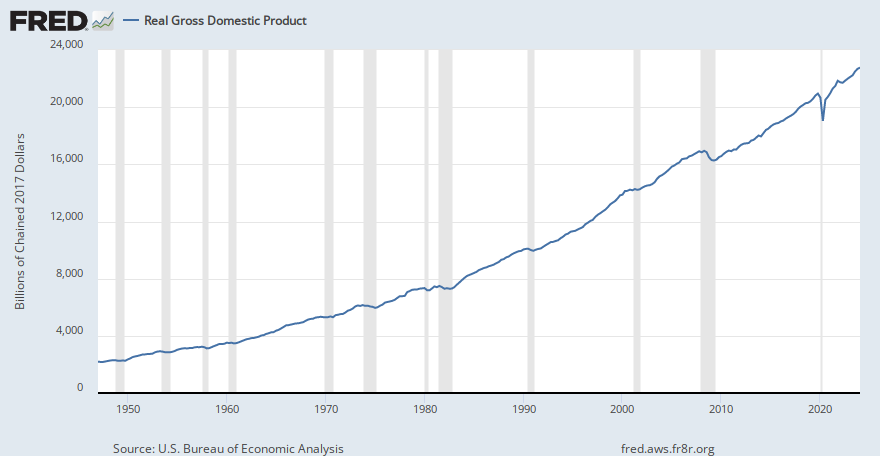

and yet in real gdp

1st quarter 2000 to Q4 2023, canada gain around 64% in real gdp.

1st quarter 2000 to Q4 2023 , US gain around 61% in real gdp.

lets not forget the US is 10x bigger...we arent comparing apple to apple imo

are you stupid that's not the point at all? yes we gained 64% gdp but it all went into housing investments so all the growth was into housing which is just a bubble and does nothing for the economy its just a place for people to hoard wealth instead of reinvesting it into the economy.

If we went from 20% to 40% of the total gdp in housing that's not good we can do some simple math

2000 100gdp = 100 x.20= 20gdp in housing leaving 80gdp for everything else

2023 160gdp = 160 x.40= 64 gdp in housing leaving 96 for everything else

so in 23 years are gdp increased 60% but it was heavily put into housing and the rest only increased about 23%

your doing these tricks to make it look like growth but 23% growth over 23 years is losing to inflation alone. I feel like you guys are used to arguing with people who don't do the math

and yet in real gdp

1st quarter 2000 to Q4 2023, canada gain around 64% in real gdp.

1st quarter 2000 to Q4 2023 , US gain around 61% in real gdp.

lets not forget the US is 10x bigger...we arent comparing apple to apple imo

also the first chart I posted clearly shows we are falling further behind them since their housing bubble burst . We have the same capital investment per working person as we did in 2008 according to that chart. Just because they are bigger does not mean we should fall behind that much per person over 15 years on average capital investment. Lets review what the posted chart says

us$ per employed worker invested

Can 2008 10$ Us 2008 13$

Can 2024 13$ Us 2024 24$

seems fine everythings fine

anyway gdp is not the same as capital investment but your the one who brought it up for some reason. Just think of it as canadas economy grew 60% but most of it went into stagnant housing

are you stupid that's not the point at all? yes we gained 64% gdp but it all went into housing investments so all the growth was into housing which is just a bubble and does nothing for the economy its just a place for people to hoard wealth instead of reinvesting it into the economy.

If we went from 20% to 40% of the total gdp in housing that's not good we can do some simple math

2000 100gdp = 100 x.20= 20gdp in housing leaving 80gdp for everything else

2023 160gdp = 160 x.40= 64 gdp in housing

first off , real estate in canada was massively undervalued in early 2000.

second that number i gave u was taking into account inflation (its real gdp charts) so u cant say 23% growth didnt even beat inflation, its real growth...

We are in a bubble now because we didnt had a correction over like 3-4 decades in many regions.

Doesnt mean all other sectors did not had plenty of investment just because real estate did not correct but other market (like oil, ressources, etc) did, so their value seem diminished.

The bubble we have is more exacerbated because of covid and low interest rates then the surplus of investment u seem to believe occur for the last 20-25 years.

i mean real estate is yes the biggest sector of the economy today but it represent like 15% of the economy.

manufacturing is right below it in second place in 2024.

yes real estate took a bigger role but there is reason for that.

manufacturing plummel for globalization, many years the canadian dollar was very strong due to high commdities price like oil, crippling the manufacturing sector in toronto and quebec for years, etc.

when u look at the numbers in the last 25 years, canada did fine, some sector got problems and others took the lead.

now today real estate is yes too big , need sa correction or a stand still like the 1990s, but that doesnt mean all other sector got forgotten the last 25 years.

many sector got massive investments like oil fwiw.

ps: if we look at population growht, US got 17% of population growth while canada like 24% since 2000, so yes, taking into account no bubble bursting, much higher population growth, will put a bigger pressure of the economy on real estate taking a bigger part of the pie in gdp .

Well real estate is more like 40% it used to be 15%. at least 40% of our money goes into it so to me that feels like 40%. of course I was never arguing the economy has not grown as a whole just that it is doing very poorly compared to all other western or g6 primarily because a lack of investment

Well real estate is more like 40% it used to be 15%. at least 40% of our money goes into it so to me that feels like 40%. of course I was never arguing the economy has not grown as a whole just that it is doing very poorly compared to all other western or g6 primarily because a lack of investment

i dont know how u calculate this but when we see gdp by sector, there is no way 40% all the money goes into real estate .

The number I saw was probably 40% of investible money. so it probably excludes things like healthcare which would skew it quite a bit. It still shows a 100% increase of money being drained into buying houses that people could be investing in the stock market starting their own businesses etc . Filter out government services and things paid with taxes from those lists and you should get close to those numbers.

Like I said this was never gdp. you posted numbers based on gdp again. Investment money does not include public services paid with taxes. its 40% of investable money not 40% of the gdp but I understand your argument of it not being 40% of Canada I think we both got lost in translation there

If we went from 20% to 40% of the total gdp in housing that's not good we can do some simple math

2000 100gdp = 100 x.20= 20gdp in housing leaving 80gdp for everything else

2023 160gdp = 160 x.40= 64 gdp in housing leaving 96 for everything else

This is just mumbo jumbo. It's a category error. GDP is a measure of production, it doesn't include the value of land or housing. Housing does contribute to GDP when you produce for instance new housing, in Canada that is a number like 8% (high compared to some other countries where it might be 4%). You can't just take Canadian gdp and start multiplying percentages for home value increases!

What I think you are misquoting here with that 40% isn't 40% of GDP, but something like 40% of gross fixed capital formation. Basically if I own a home all my life and it's value goes up, the contribution to GDP is nothing (I still have to live in the home, I can't easily at least take that increased value to start a business), but if one is doing the accounting capital formation has occurred.

But even 40% is nowhere close to the 70% number you were quoting either. So again, I want to ask, what PRECISE economic measurement was the 70% supposed to be measuring?

I know it doesn't rofl you didn't read it all did you I was just giving an example after he brought up gdp. ( i didnt bring up gdp) . why are you so stuck on this 70% number. The number I was referencing was 70% housing capital investment vs 30% rnr investment in canada and its probably closer to 60-40

The number I saw was probably 40% of investible money. so it probably excludes things like healthcare which would skew it quite a bit. It still shows a 100% increase of money being drained into buying houses that people could be investing in the stock market starting their own businesses etc . Filter out government services and things paid with taxes from those lists and you should get close to those numbers.

Ok I see .

Maybe you are referencing to a chart like this :

Disposal income vs the cost of mortgages past years ?

COVID was painful in that regard

The reason I use gdp it’s because if there was huge amount of money like the one I thought u were alluding too , we would of seen it in massive economic activities number which would be translated in gdp .

Fwiw I’m not a big fan of the immediate correlation that because people pays more in mortgages they have less money to invest .

First I’m not sure Canadians been great investors to begin with .

Myself I was almost fully clueless the first 30 years of my life but I knew early on that buying a house was a good alternative (like probably the majority of Canadians) .

And even today when I look and talk around me , the illiteracy of investing is staggering high still to this day .

And that explain probably a lot about the housing bubble today which bad decision all over on prices and interest rates not locked in for long term .

And I’m not sure them having more money would translate in investing more anyway .

They didn’t seem to do so even in 2006 , quite the contrary since then .

And I must say there is always 2 part in this equation .

1 spending is someone less Income …

Yes people that buy houses got less money to invest elsewhere but what about those that sold those houses at premium prices in last few years ?

They gained massively new money In their hands to invest right ?

Far more they could ever dream of before the last decade .

Mostly boomers , retirees , downgrading living spaces , having lots of cash to invest since their expenses at that age should diminish quite a lot .

And finally not all Canadians have an house too or want one .

But I get your point , I’m just not in your camp that the damages as u sugggest about the lack of investment due to high house /mortgage prices is as high as u think it is .

There is probably a cost not has big due to factors I enumerated .

But yea , we are in a bubble .

Better allocations of capital could be made ( which is what creates bubbles in the first place -> mis allocation of capital) .

And their was bad policies (still is today) on the provincial, city and federal too in the mix .

But inflation coming down and interest rates as well .

Let’s see how it goes from here .

Imo the good thing the past few years it’s maybe it wake up some people about what can happen in housing and should think more about prices means when u buy a house .

I know it doesn't rofl you didn't read it all did you I was just giving an example after he brought up gdp. ( i didnt bring up gdp) . why are you so stuck on this 70% number. The number I was referencing was 70% housing capital investment vs 30% rnr investment in canada and its probably closer to 60-40

Ok. I think you are right in spirit but wrong in actual numbers. That is, I agree that Canada’s very expensive housing means a lot of “capital investment” is spent on land and buildings and not things that increase the productivity of Canada’s economy, more so than the US, and that this is a problem. I agree. I am just not aware of a metric that is at either 70 or 60%. I think it is more like this:

However, the report’s author attributes this mostly to the “enormous investments made in housing in Canada versus the U.S.” From 2014 to 2021, housing accounted for 34.1 per cent of total investment in Canada, versus 18.5 per cent for our neighbour to the south.

Maybe you are remembering some other slightly different metric but the exact name has gotten lost in translation.

ya 34 is 70% more then 18.5

18.5x.7=12.95

12.95+18.5=31.45

so Canada has 70% less rounded up . you got me I used a source from memory on a pointless internet forum I have no investment in and used it slightly wrong. But it still shows a trend and shows the idea then I followed it up with actual hard data and graphs which you of course ignored because you probably have an agenda so you only care about pointing out the small mistake. 70% less is very worrying

here's what I originally said that you were so stuck on

for example america puts like 70% of excess capital into improving businesses and production and we put like 20% because it all goes into purchasing homes

we can fix it! lets delete 1 word and add in 2 words

for example america puts like 70% (more) of excess capital into improving businesses and production and we put (less) because it all goes into purchasing homes

here's the slight correction you were so jammed up about

Ok. I'm not quite sure why you are speculating about hidden agendas. You said something that didn't pass the smell test based on my rough memory of the numbers and so I wanted to figure out what was actually meant. It seems we have now done so. That's about the end of it imo.

Of course the recent discussion from lozen is just because he parrots poilievre