Trump 2nd term prediction thread

So, looks like Trump not only smashed the electoral college, but is looking on track to win the popular vote, which seems to be an unexpected turn of events, but a clear sign of the current temperature in the country and perhaps the wider world.

Would be interested to hear views on how his 2nd term will pan out from both sides of the aisle - major happenings, what he's going to get done, what he's not going to get done, the impact of his election on the current conflicts in Ukraine and Gaza, whether his popularity will remain the same, wane, or increase, etc.

A bit of an anemic OP, I know, just interested to hear people's thoughts now that the election uncertainty is over.

no I get it. to a Dem supporter, a good idea (your words lol) is commuting a child tracker.

I'm an American supporter. Maybe you're confused because you posted a clip about Rita. If you're talking about the cash for kids judge... do you really think anyone is OK with that? It's not a liberal or conservative thing. It's a call in a favor corruption thing.

Have you taken a look at the incoming administration, though? It's full of sexual abusers and Epstein buddies.

do you really think anyone is OK with that?

yes

The USA is not a business. If you don't understand this, you likely won't understand much of how government should ideally function.

People who have been successful in the past, tend to be more successful in the future than those who were never successful. If you don't understand this, keep up the hopium.

Now he just has to pardon a couple of rappers and he'll be neck and neck with Trump. Not to be outdone, perhaps on day one Trump will pardon Bankman-Fried and they'll create an NFT together.

no, Bankman-Fried was a democrat agent.

possible Biden still let's him off.

Trump will pardon Ross Ulbricht.

Okay "buybacks" can't be simplified or categorized into one basket as far as whether they are humble or sincere or whatever tf is being argued. It's just another option.

A lot of the monstrous companies - tech and oil, the 50b + companies have done share repurchasing after covid because they felt that their company was undervalued enough for them to put their cash to better use. Often times, when those buybacks happen, or when someone like Buffett makes a large purchase, it's usually wise to follow suit there imo. When Apple repurchases, they usually end up alright.

But you also have the other side, the struggling super small cap, deceptive, or outright fraudulent businesses repurchasing shares to give the illusion that they are more solvent than they appear or that their bankruptcy odds, for w/e leverage that may offer is lower than it is. Unfortunately, that happens a lot more now and savvy investors can still generally sniff out the difference.

So it's just another tool, and in short, if big companies do that its a +, and if small companies do that its' prolly more likely a negative with those odds going up rather dramatically the smaller the company is.

Because in a vacuum, small companies are mostly overvalued anyway while the larger or more priced accordingly. Its just the way it is.

no, Bankman-Fried was a democrat agent.

possible Biden still let's him off.

Trump will pardon Ross Ulbricht.

Lol SBF donated more than 100 million dollars, stolen from account holders on FTX, to democrats

Lol SBF donated more than 100 million dollars, stolen from account holders on FTX, to democrats

I’m sure the Democrats returned that money to the folks that were scammed . Not

I consider myself a regular investor. I would much prefer buy backs. Why? The value of my investment goes up and I still control the timing of realizing my profit.

If you are investing outside of tax advantaged accounts ie over 30k a year you would not be a good representative of regular investors. For them dividends are better because they put those profits back into the whole market rather than 1 company and you still realize profit whenever you want. Obviously if 30k a year is small compared to how much you invest buy backs are better.

A lot of the monstrous companies - tech and oil, the 50b + companies have done share repurchasing after covid because they felt that their company was undervalued enough for them to put their cash to better use. Often times, when those buybacks happen, or when someone like Buffett makes a large purchase, it's usually wise to follow suit there imo. When Apple repurchases, they usually end up alright.

That's the thing though.....most companies don't buy back stock because they think their company is hugely undervalued (granted I'm skeptical they could figure out when that is even if they were trying to). They do so because they have money they want to return to shareholders and buybacks are better than dividends for the ones who decide. Even if buybacks destroy value in the long term over dividends, it's better for larger holders to knowingly destroy that value and avoid taxes. While Joe Blow 401k is worse off.

Nah, it's just a statement of fact. Of course the tax advantage of buybacks would make them better than dividends for the relative few that have to pay taxes on dividends even in the worst realistic case scenario of dividends being a little better ignoring taxes. That's not true for regular investors.

If you are investing outside of tax advantaged accounts ie over 30k a year you would not be a good representative of regular investors. For them dividends are better because they put those profits back into the whole market rather than 1 company and you still realize profit whenever you want. Obviously if 30k a year is small compared to how much you invest buy backs are better.

You would be representative of the regular investor weighted for stock ownership.

And when you retire you aren't tax free anymore and guess who , among regular people , owns the most stocks?

Nah, it's just a statement of fact. Of course the tax advantage of buybacks would make them better than dividends for the relative few that have to pay taxes on dividends even in the worst realistic case scenario of dividends being a little better ignoring taxes. That's not true for regular investors.

"relatively few" including the totality of the retirees with any stocks lol (except those with 100% in Roth IRAs), the totality of foreign investors even if small ones, and all rich people residing in the USA.

Ie, for the vast majority of people owning sp500 stocks, buybacks are better than dividend.

And, guess what, what is better for the vast majority of the people is better for the "regular ones" you want to care about as well, because if the sp500 is tax disadvantageous for someone, at the margin he will buy fewer stocks , which is bad for the totality of stock owners.

So, what is good for most stock owners is good for all stock owners. Buyback are objectively better for ALL stock owners, taking second order considerations into play.

"relatively few" including the totality of the retirees with any stocks lol (except those with 100% in Roth IRAs), the totality of foreign investors even if small ones, and all rich people residing in the USA.

Ie, for the vast majority of people owning sp500 stocks, buybacks are better than dividend

Do you know how taxes are paid if 100% of your investments are in a 401k? Because I feel like only someone who is totally clueless on that could write the above.

Do you know how taxes are paid if 100% of your investments are in a 401k? Because I feel like only someone who is totally clueless on that could write the above.

Do you know you are mandated to take money out of it at some point yes? currently that happens at 72 (but for the people you talk about, it happens sooner because of necessity).

At that point the fiscal distinction between dividends and buybacks disappears for them.

And how clueless can you be to completly disregard the fact that approx 1/3 of the sp500 is foreign owned, and the foreign withholding tax makes a MASSIVE difference for each and every one of them? and so for every one who owns stock, because everything that affects demand for stocks affect their value, including for people who could care less about "foreign withholding taxes"?

btw ecriture it just occurred to me even your purported favourable distinction for "normal" account holders doesn't exist.

If they think they are better off investing in the broad market they can always sell tax free within their IRA or 401k and reweight whatever stock they think is overvalued because of buybacks (lol).

You just made up the whole concept.

Do you know you are mandated to take money out of it at some point yes? currently that happens at 72 (but for the people you talk about, it happens sooner because of necessity).

At that point the fiscal distinction between dividends and buybacks disappears for them.

Lol. One day I feel like we'll discover a topic you're not completely clueless on and it will be like watching a dog play the piano.....perhaps another day. No matter when you take money out of a 401k dividends and buybacks are the same.

btw ecriture it just occurred to me even your purported favourable distinction for "normal" account holders doesn't exist.

If they think they are better off investing in the broad market they can always sell tax free within their IRA or 401k and reweight whatever stock they think is overvalued because of buybacks (lol).

You just made up the whole concept.

Lol....people have maybe 7 different options within their 401k. There is no mechanism for them to reduce say large cap tech exposure and "re-balance" to the rest of the SP500 within their 401k. By number of shareholders, this is the largest group of investors. You can't help how smart you are, but you could honestly just not talk about stuff you have no clue about.

That's for bad 401ks. Between my wife and me, we've had accounts at Schwab, Vanguard, Fidelity, and Voya. In each case we could choose anything they had to offer. I agree that many people have to choose between fewer than a dozen crappy options. But I bet almost all of them have at least one broad based fund.

That's for bad 401ks. Between my wife and me, we've had accounts at Schwab, Vanguard, Fidelity, and Voya. In each case we could choose anything they had to offer. I agree that many people have to choose between fewer than a dozen crappy options. But I bet almost all of them have at least one broad based fund.

Sure....but my point was that a regular investor in those broad based funds would be better off buying back the whole fund if NVDA wants to return money to shareholders rather than just NVDA. A regular investor can't somehow do that by himself with re-balancing in their 401k.

That's the thing though.....most companies don't buy back stock because they think their company is hugely undervalued (granted I'm skeptical they could figure out when that is even if they were trying to). They do so because they have money they want to return to shareholders and buybacks are better than dividends for the ones who decide. Even if buybacks destroy value in the long term over dividends, it's better for larger holders to knowingly destroy that value and avoid taxes. While Joe B

Okay, buy when Microsoft did a 60b stock buyback 3 months ago, while increasing their dividend, as well as all the times in the past, they're doing so because the company will likely outlive their investors and likely offer far better returns for the money than any other form of investment - like it did in all of their previous purchases. It doesn't destroy the long term value of the company. They also absolutely have the best idea on whether their own company is particularly undervalued or not, so I wouldn't argue against there being some form of unfairness or even insider trading in that regard.

But more importantly, dividends are illusions and aren't free money. If a stock pays a 2% quarterly dividend on monday, the stock price drops 2%, all else equal. So if I am invested $100 on stock abc when it pays a 2% div, my stock investment is at 98 with my cash account being at $2. Essentially, anyone could pay themselves any size dividend they wanted to on their own behalf, with the same result.

...but I won't disagree that there are far more nefarious forms of company buybacks with other companies.

Okay, buy when Microsoft did a 60b stock buyback 3 months ago, while increasing their dividend, as well as all the times in the past, they're doing so because the company will likely outlive their investors and likely offer far better returns for the money than any other form of investment - like it did in all of their previous purchases.

And that would be a good argument if buybacks were as rare as companies like Microsoft. Instead you have companies like Bed Bath and Beyond doing buybacks in 2018 at all time highs and going bankrupt in 5 years. These are both extremes and should probably be ignored. Though obviously what a megacap like MSFT does matters way more to an indexers returns.

It doesn't destroy the long term value of the company. They also absolutely have the best idea on whether their own company is particularly undervalued or not, so I wouldn't argue against there being some form of unfairness or even insider trading in that regard.

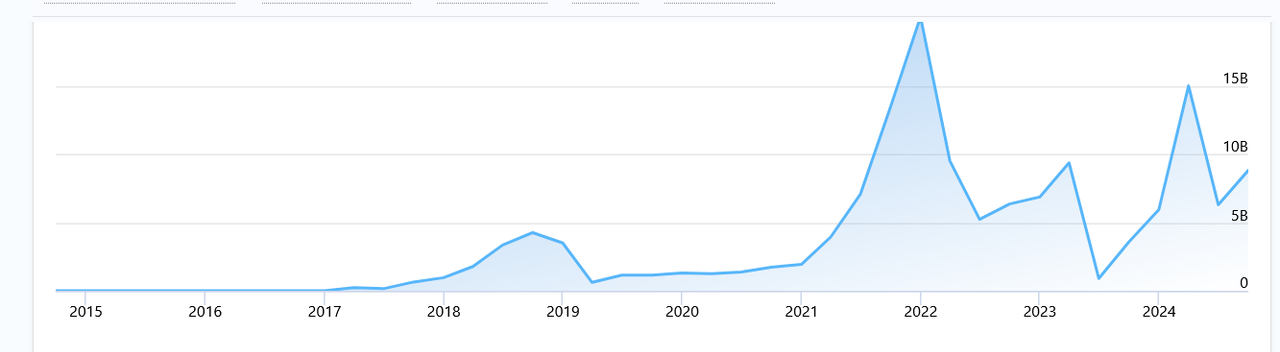

I don't think any analysis would show this. Anecdotally, Facebook is the company I casually follow the most. I was probably one of the first 3k people in the world to use it and have owned shares since before the IPO. This is their buyback chart

You can see it peaked last quarter 2021 and crashed 2022 and 2023 before recovering. Pretty much what the stock itself did. This makes perfect sense. They had a really bad earnings report in the first half of 2022 with concerns on Apple default privacy settings, metaverse cash burning and lower than expected daily users and money per user so they ramped down buybacks..... at the exact time they should have been going all. This makes perfect sense and happens all the time. It's hard to justify a huge uptick in buybacks when there are a bunch of problems with your business.

But more importantly, dividends are illusions and aren't free money. If a stock pays a 2% quarterly dividend on monday, the stock price drops 2%, all else equal. So if I am invested $100 on stock abc when it pays a 2% div, my stock investment is at 98 with my cash account being at $2. Essentially, anyone could pay themselves any size dividend they wanted to on their own behalf, with the same result.

Yes, dividends and buybacks both decrease book value by the exact amount issued. Don't think anybody is arguing against this.